Capital Easy work with their clients to provide either on or off-balance sheet financing for their equipment needs.

We provide a strategy for total life cycle management that delivers greater accounting and administration efficiency and allows

you to conserve valuable working capital and increase returns to your business.

A Capital Easy Lease will enable your business to remain competitive and keep up with the rapid pace of technological change,

which is essential in today’s competitive business environment.

CAPITAL EASY

We are an experienced group of finance professionals with a vision to develop an industry leading business. Our innovative financial structuring assists Government, Education and Commercial business in whole of lifecycle equipment acquisition. We solve the dilemmas’ of upfront capital demands – by amortising the cost of such equipment or software over its business useful life – either on balance sheet or off.

Additionally, our in-house Reuse-RecycleIT division provides valuable secondary remarketing of your surplus equipment so as you obtain the highest sale value on your old equipment, resulting in the lowest cost term usage by the business.

The Capital Easy Group are world class business asset solution providers, whose capabilities span from simple equipment financing, to complex compliant financial modelling or detailed asset management and ICT disposal solutions. An ISO 14001:2015 certified organisation – and a member of the Australian Valuation Institute, we know that only a business with the highest values can deliver strong and sustainable results for your business success.

Our goal is to help client business’ reach their equipment ambitions in the most efficient way.

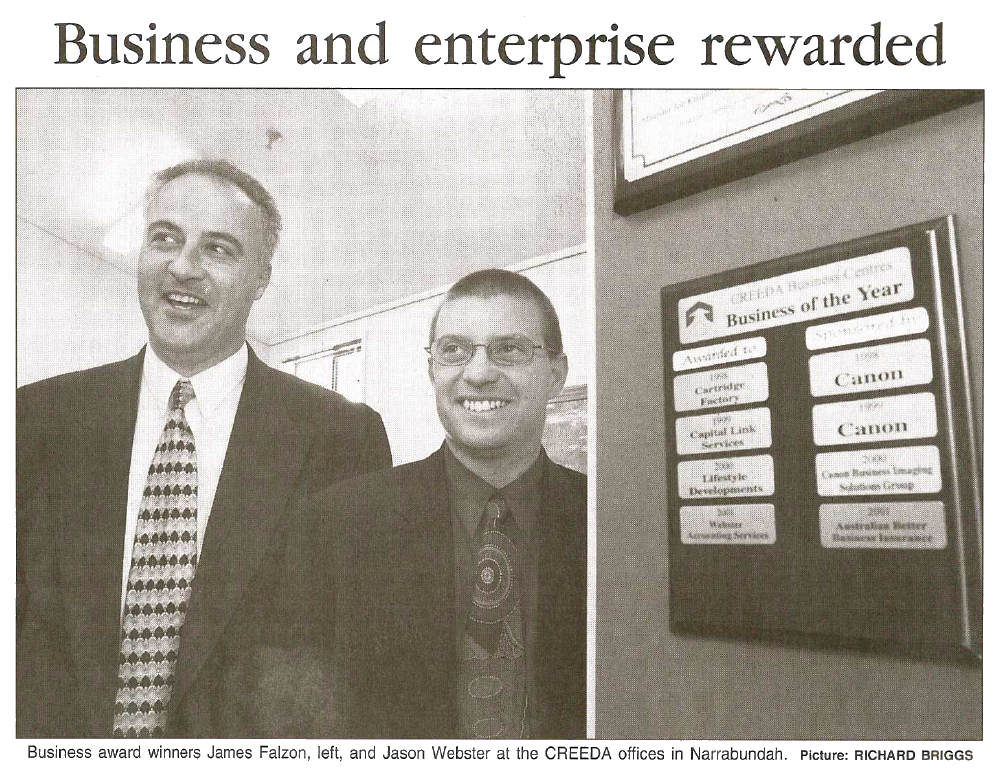

Our focus on personal service and customer solutions is a driving priority. This means that when you engage Capital Easy, one of our experienced and professional officers will oversee each element of the acquisition from start to finish. It’s this end to end Customer focus that sets Capital Easy apart from others and why it was judged ACT Small Business of the year.

Accredited by the Commonwealth and ACT Governments, Capital Easy deals with a wide and diverse range of clients. So whether you’re an individual, a sole trader, a large corporate or, a government department Capital Easy can assist you with your business equipment needs. CAPITAL – the Easy way…

THE CAPITAL EASY GROUP

The Capital Easy Group has three branches, all aimed towards business’ and the lifecycle of their equipment. We are comprised of……

Capital Easy Finance & Leasing

Financing business equipment in an efficient, productive and tax effective manner. Capital Easy work with their clients to provide either on or off-balance sheet financing. A Capital Easy Lease will enable your business to remain competitive and keep up with the rapid pace of technological change, which is essential in today’s competitive business environment.Reuse-RecycleIT

Specialising in the facilitation and logistics management of recycling and reusing end-of-life IT and office equipment. RRIT aims to get maximum returns for your business from its redundant assets.

https://Reuse-RecycleIT.com.auDrive Easy Vehicle Finance.

Providing fast business vehicle finance without putting a strain on your cash flow. We provide funding for both new and used vehicles from either a local or interstate dealer or private sale.

https://DriveEasyFinance.com.au

CORPORATE BACKGROUND

Capital Easy Finance & Leasing is the leading function of the Capital Easy Group. Capital Easy, was formed in Canberra over 20 years ago to meet the needs of the Commonwealths IT funding requirements and has dedicated itself to providing complete financing solutions for government and corporate clients across Australia.

By way of example Capital Easy is a financier to the CSIRO, Department of Finance and ACT Government for in excess of 17 years. It is this end-to-end hands-on experience that gives Capital Easy the confidence that the support arrangements for your business equipment funding will be exceeded.

James (Founder and CEO)

Bachelor of Business (Marketing) and currently studying an MBA (RMIT)

James has arguably the most extensive pedigree available in specialist IT leasing and asset services to Government, Business or Industry. He has spent much of his 35-year career within the insurance and finance discipline. James has worked as a specialist State Manager for equipment financier (Elderslie) for over six years and was then appointed to its Board of Directors.

James has provided total master leasing services for Australian Government: Department of Foreign Affairs and Trade, Information Technology, Communications and the Arts, Health, Treasury, Veterans’ Affairs, Defence and numerous Australian government agencies since 1996.

James has highly regarded client management and negotiation skills. He is also an innovative thinker, a natural problem solver and prides himself on exceeding client expectations in all of his customer dealings. He is an excellent communicator and is actively involved in all major accounts and the community generally. James and his family live locally in the ACT.

James is a registered Stock and Station Real-estate Auctioneer (not practicing), and is a member of the Australian Valuers Institute.

CAPITAL EASY Products

As vital as new equipment is to your business, equally important is financing it in a way that is efficient, tax effective, and maximises productivity. Capital Easy will work with you to structure your lease to meet any special business cash flow requirements you have.

Whilst we provide a comprehensive range of Business Products, our leading capability is in providing Operating lease. Other products include Finance Lease, Commercial Hire Purchase, and Working Capital Finance. Capital Easy will structure a solution to meet your Business needs.

Equipment Financed Includes:

IT equipment (Computers, networks, printers etc)

Telecommunications (PABX’s & Handsets)

Gaming Equipment

Medical & Dental

Plant & Machinery

Office fit out & equipment

Fork Lifts, Pallet trucks, Bulldozers & Graders

Core Competencies

The ability to provide an Operating Lease Product that conforms to Australian Accounting Standard (AASB 16).

Flexible & Transparent. Capital Easy is a wholly owned Australian business (SME) who assist in Financial structuring across Australia from either small business to large corporate or Government.

Trade in and disposal of obsolete Equipment ( & replacement).

“Sale and Leaseback” of equipment to untie held business capital.

Demonstrated Capability to provide Terms and Conditions acceptable to the Australian Government Solicitor.

Flexible leases that allow you to “add-on” or upgrade the equipment during the term.

CE Master Facility

A master lease facility provides business with a pre approved fixed credit limit as part of your initial approval. It allows the business to draw down against this limit as required. Further drawdowns do not require further credit assessment, and are simple schedule setting out the payments for that contract.

Once drawn, rates are fixed for the term. Prearranged benchmarks are provided in the event of interest rate fluctuations during the term of the facility.

Administration and Invoicing is simple and can be dispatched under a single statement or to individual cost centres.

Terms may vary on each draw down from 6 months to 5 years.

One cost payment – You can include maintenance, service, training, & Integrated Services.

The Business may set and vary payments to suit cash flow under each draw down.

Asset Management

Capital Easy can provide tailored Asset Management Solutions from simply providing your business a password protected access to asset information via. the Web or a completely outsourced service of Life cycle Asset management and Asset Audit services.

Either way, Capital Easy can help you keep track of the details relating to your asset Management allowing you to concentrate on the “Bigger picture”.

Asset Valuation

Capital Easy can provide a certified valuation service to assist in confirming “book value” of assets or for disposal.

Trade Ins

Capital Easy uses its knowledge of wholesale and retail markets together with intelligence gained from additional research to determine market-leading trade in values.

Capital Easy holds strategic relations with Australia’s leading re-marketers of equipment ensuring your business maximises the value of any trade in with the guarantee that what you get paid isn’t eroded by transport or auction costs.

FAQ

Under an operating lease you agree to a minimum number of rental payments being made, at the end of that term you have a number of options open to you these are:

- To rent new equipment.

- To continue to rent the same equipment at discount to your previous payments.

- To return the equipment

- To buy the equipment at market value.

We lease to businesses, incorporated bodies, schools and government. We do not lease to home users for individual purposes.

Depending on the approval value we would need a copy of your financial accounts and business references. If you give us permission to contact your accountant we will save you time and get all the information direct.

Testimonial

ActewAGL confirms that Capital Easy has been a significant supplier of ICT Financing and disposal services for many years. ActewAGL utilises the Reuse-RecycleIT division of the business for end of life solutions for e-waste and retired technology. Being a company with environmental responsibilities including ISO 14001 certification, it is important to ActewAGL that we ensure our end of life solutions align with our responsibilities.

For this reason, we utilise Reuse-RecycleIT, who are likewise ISO 14001 certified, for managing end of life obligations.

James and the team at Reuse-RecycleIT are dedicated to providing professional and timely services, having supporting ActewAGL through major business change, from divestments through to data centre retirement.